I originally wrote this article in early 2015 after a five-year bull market. The point of the article was to show that becoming a self-directed investor and managing your portfolio without the help of a financial advisor could yield materially better returns. This repost in mid-2022 found the financial markets in an official bear market after reaching all-time highs in early January 2022.

Over the last five years (2010 - 2014) the US Stock Market has been in a very strong bull market. Research has shown that individual stocks typically track the S&P 500 about 75% of the time. That means that 3 out of 4 stocks will trend with the broad market.

Over the last five years (2010 - 2014) the US Stock Market has been in a very strong bull market. Research has shown that individual stocks typically track the S&P 500 about 75% of the time. That means that 3 out of 4 stocks will trend with the broad market.

In a strong increasing market, an investor can pretty much “throw a dart” and perform about as well as the overall market. Professional money managers contend they know something or have an edge that the individual investor cannot replicate. I call BS!

I am passionate about encouraging individual investors to become “self-directed” investors. You might say I have a personal vendetta. I had my $250,000 Roth IRA retirement account invested with Bear Stearns in the late 1990s. They lost all but $13,000 and financially devastated me. I will do everything in my power to educate individual investors so that does not happen to them.

After the debacle at Bear Stearns, I set out in 2003 to learn everything I could learn about investing in stocks, bonds, ETF’s and futures. Like many new investors, I took my lumps, but I persevered to where today I am confident in what I do and what I can help others to achieve consistent, predictable returns. Ask your financial adviser if he/she can generate predictable results for you??

They lead individual investors to believe by the “self-serving” financial advice industry that it is far too complicated for you to manage your own account. Nothing could be further from the truth. In fact, I dare say that with a little direction and familiarity with the technology today, in just a few short months, you will know more than a large majority of the “asset gatherers” themselves.

Of course, they will do their best to keep you. The total annual fees that are generated by the financial advice industry are over $600 billion..... that is with a “B”! Remember that these fees they generate don’t come out of thin air; they come out of every investment account. You may be further surprised to find that you share about 40% of your annual gains with your financial advisory firm. And you pay them win or lose!

There are many methodologies that the individual investor can employ to generate consistent, predictable returns that outperform those of the “money suckers”. The financial advice industry points too many “so called” solid trading methods to prove their point that it has to be too hard and too confusing for a “non-professional” to become proficient managing their own account.

Armed with a bit of knowledge and familiarity with technology, there is no way I could perform as poorly as Bear Stearns did for me. Don’t allow them to mislead you!

There are thousands of mutual funds available for the financial adviser to “sell” you. Yes, sell you, as the mutual funds handsomely paid them for depositing your funds. Then, on top of the mutual fund loads and early termination fees, your adviser charges between 1% and 2%.

What if I told you by placing one trade per week in your self-directed account and outperform the top mutual fund since 2010? You could spend a few minutes of your time and outperform the absolutely best performing mutual fund over the past five years!

My friends at the Tastytrade Financial Network recently conducted a five-year study comparing one simple credit spread trade executed every Friday against the number one mutual fund from 2010 to the present. Of course, the chance of your “expert” having you in the very best mutual fund for the last five years is about the same as your chance of walking on the moon.

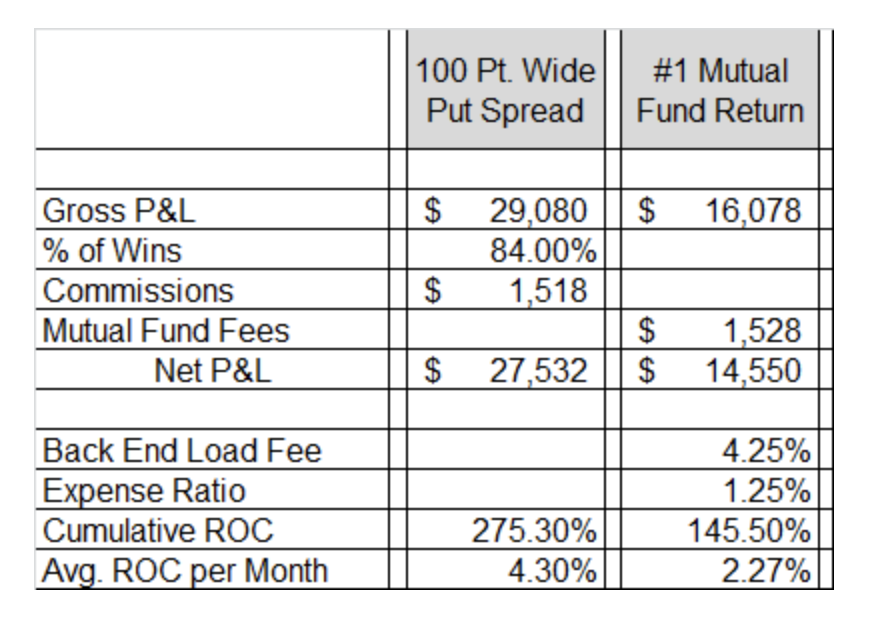

The study compared selling a simple put spread every Friday, closing it the following week. They compared this to investing $10,000 in the number one performing mutual fund over the last 5 years. Again, let me remind you how unlikely it would be for you to find your account invested in the top performing fund.

This study confirmed that the individual investor can outperform the professional “asset gatherer” that invests your account into a mutual fund. With a little knowledge, you can spend about 5 minutes each week executing the simplest of strategies and you can materially outperform the “self-proclaimed” professionals. As the study proved, the difference for an account size of $10,000 is $27,532 (17,532 gain) versus $14,550 (4,550 gain) for the five-year period. That is a difference of $12,982 in net gain! And that is only on a $10k account!

Now think about that. You spend five minutes each week executing the trade and you nearly double the performance of the top performing mutual fund for the five years 2010 through 2014. They said you couldn’t do it!

Let me share with you the results of the study:

In conclusion, I hope you will spend some time comprehending the results. Your financial existence could rely on it.